kaisarjudi123.ru

News

How Much Does Making A Pool Cost

The investment for an inground fiberglass pool spans a broad spectrum, typically ranging from $40, to upwards of $,, influenced heavily by the pool's. 1. In-Ground Pool. On average, you can expect to spend anywhere between $28, and $55, for in-ground pools. But keep in mind that the cost can go even. Generally speaking, a basic custom inground pool costs on average around $50, However, the more enhancements you add, the higher the cost goes. Extra. You can either do this yourself or hire pool opening contractors to do this for you (average cost in the GTA is around $). What's the estimated cost for an inground pool? · Basic pool with lights and minimal concrete, medium-sized (14' x 30'): $45, · Upscale pool with water. Orange County Pool Contractors Reveal Inground Pool Costs. Inground swimming pool prices depend on several factors, including the type of pool, size, shape. The average cost to install an inground pool in is between $80, and $, The pool itself is less than that, but by the time you add stone, concrete. So, how much to install a fiberglass pool? Fiberglass pools cost on average $30, to $50,, with a high-end inground fiberglass pool costing $60 to $ per. According to estimates from kaisarjudi123.ru, the average cost in the United States for installing an in-ground swimming pool is between $35, and $65, The investment for an inground fiberglass pool spans a broad spectrum, typically ranging from $40, to upwards of $,, influenced heavily by the pool's. 1. In-Ground Pool. On average, you can expect to spend anywhere between $28, and $55, for in-ground pools. But keep in mind that the cost can go even. Generally speaking, a basic custom inground pool costs on average around $50, However, the more enhancements you add, the higher the cost goes. Extra. You can either do this yourself or hire pool opening contractors to do this for you (average cost in the GTA is around $). What's the estimated cost for an inground pool? · Basic pool with lights and minimal concrete, medium-sized (14' x 30'): $45, · Upscale pool with water. Orange County Pool Contractors Reveal Inground Pool Costs. Inground swimming pool prices depend on several factors, including the type of pool, size, shape. The average cost to install an inground pool in is between $80, and $, The pool itself is less than that, but by the time you add stone, concrete. So, how much to install a fiberglass pool? Fiberglass pools cost on average $30, to $50,, with a high-end inground fiberglass pool costing $60 to $ per. According to estimates from kaisarjudi123.ru, the average cost in the United States for installing an in-ground swimming pool is between $35, and $65,

Building a residential swimming pool does not come cheap. Therefore, the cost you incur for the project is a crucial aspect you must consider. With a middle-of-the-road budget, you can build a swimming pool for $19, to $52, or more, depending on the features. It is also important to understand that this baseline is just an average on what you can expect to pay for a new pool. Luxury pools and custom outdoor living. In the El Paso Pool Cost Report, you'll find the average cost for a standard in-ground pool ranges from $35k-$65k, while fiberglass and vinyl installation costs. On average, the cost to build a pool will range anywhere from $30, to $,+. It's all about what you're wanting to get and how much you can affordably. The cost of building a custom pool in Utah ranges between $ to over $1 million depending on several factors. Learn more here! How Much Does a Typical Inground Pool Cost in Columbus, OH? In Columbus, Ohio, a basic inground pool installation typically ranges from $30, to $60, The average cost is between $ and $ depending on the type of pool, but each pool build is unique. Read more. For a more comprehensive pool and backyard project in San Diego, homeowners should anticipate starting costs between $, and $, Remember, these. The average cost to build a pool is around $41,, but the final cost depends on the type and size of the pool. Above-ground pools cost around $ to $5, The average cost of an in-ground pool may cost around $$, depending on the number of features you want to be added. The price of the labor and. On average, an in-ground swimming pool costs between $35, and $65, With customization and special features, the overall expenses can reach upwards of. Fiberglass pools (again, when done correctly) will start in the $45, range and max out around $75, or so. A fiberglass pool is just like a bathtub. It is. Let's take some time and look at the cost considerations of purchasing and building a swimming pool. Costs below are approximate costs from the historical data. How much does an in-ground pool cost to build? It costs around $25, to build an in-ground pool. While the typical cost to build a pool can range from. Installing an in-ground pool can be expensive; the larger, the more expensive. Pools do require maintenance. They must be skimmed, swept or vacuumed frequently. Fiberglass Pool Costs Per Size · Small fiberglass pools – sized from 10′ x 20′ up to about 13′ x 27′ = $70, – $75, · Medium fiberglass pools – sized. Purchase costs of inground pools Each inground pool is unique. They can easily vary in price from $20, to $45, depending on type, materials, size, shape. For example, the identical, basic 15 x foot pool and its features may have a starting base price of $45, in Phoenix or Tampa—and $75, in Raleigh or. Average cost to install an indoor swimming pool is about $ (12'x24' concrete base with vinyl liner). Find here detailed information about indoor pool.

Bank Check Verification Process

Benefits of Verifying a Customer's Bank Account · Less money spent on traditional check processing. A business that accepts ACH transfers will have fewer paper. Checks essentially provide a way to instruct the bank to transfer funds from the payor's account to the payee or the payee's account. The use of checks allows. They generally work through banking apps that connect directly to the customer's bank account, alerting the store if there are insufficient funds for their. What information is required for a requestor to receive a consumer verification? · A request submitted in a standard form with authorization from the customer. The verification process is initiated with a requisite endorsement on the back of the check and the accurate input of the check amount in the app. Instant bank verification (IBV) verifies the user's bank account number and account details before processing any valid transaction. The whole idea behind it is. Also, while not common, a US Treasury Check can be hand signed as opposed to signed by an automated process. This website is available for use 7 days a week. A certified check is a personal check that has been verified and guaranteed by the issuing bank. The bank sets aside the check amount in the payer's account and. Benefits of Verifying a Customer's Bank Account · Less money spent on traditional check processing. A business that accepts ACH transfers will have fewer paper. Benefits of Verifying a Customer's Bank Account · Less money spent on traditional check processing. A business that accepts ACH transfers will have fewer paper. Checks essentially provide a way to instruct the bank to transfer funds from the payor's account to the payee or the payee's account. The use of checks allows. They generally work through banking apps that connect directly to the customer's bank account, alerting the store if there are insufficient funds for their. What information is required for a requestor to receive a consumer verification? · A request submitted in a standard form with authorization from the customer. The verification process is initiated with a requisite endorsement on the back of the check and the accurate input of the check amount in the app. Instant bank verification (IBV) verifies the user's bank account number and account details before processing any valid transaction. The whole idea behind it is. Also, while not common, a US Treasury Check can be hand signed as opposed to signed by an automated process. This website is available for use 7 days a week. A certified check is a personal check that has been verified and guaranteed by the issuing bank. The bank sets aside the check amount in the payer's account and. Benefits of Verifying a Customer's Bank Account · Less money spent on traditional check processing. A business that accepts ACH transfers will have fewer paper.

How Bank Account Verification Works · Submission of Bank Account Details: The individual or entity wishing to verify a bank account submits the relevant details. Checking account verification options range from automated routing number check to negative database options to near real-time inquiries into current checking. The Federal Reserve Banks' Check Services offer you a suite of electronic and paper check processing options to support all of your needs. After completing the manual verification process, Checkbook will make two micro-deposits to your bank account. You will need to enter those amounts to verify. The payment is deposited in your bank account as soon as the next banking day. A view of orange interweaving electric cords. A woman in a shop looking a tablet. Visit the bank where the check was issued. · Present the check to a teller and request verification. · Provide any additional information. True authentication can only be provided by the bank or the payer, according to Online Check Writer's policy. To ensure security and safety for customers. The instant bank verification (IBV) process verifies that the bank account number and account details are valid before a transaction is processed. Verifying. Instantly verify bank accounts For faster and easier account funding, pay by bank, loan repayments, and everything in between. A multi-step process for. Nickname for account - great for when you have multiple accounts · Bank Name · Account Type - checking or savings · Name of Account Holder · Routing number · Account. They generally work through banking apps that connect directly to the customer's bank account, alerting the store if there are insufficient funds for their. Bank account verification is a necessary part of the ACH transaction process that ensures funds are coming from and going to legitimate bank accounts. account using the Mobile Banking app with Mobile Check Deposit from Bank of America Mobile check deposits are subject to verification and not. This step in the electronic verify check payment process aims to ensure that the consumer “consents” to giving over their money. Verifying the senders' account. A Check Verification Service allows a business to validate that an account is open and in good standing prior to the account being loaded into a recurring. Even before Check 21, banks were allowed to process checks electronically when all the banks in the process agreed. Under Check 21, any bank may create a. Bank verification is to be done using their bank statement / online banking data instead. You can always forward the verification email to your client to. Bank account verification involves confirming the ownership and legitimacy of a bank account through various verification methods. These methods may vary. Bank account verification is the process of verifying the bank account details of the customer. This ensures that the bank account they are dealing with. Check verification is a system that uses the Routing Number, the Account Number, and optionally the Amount of the Check and the Check Number to determine if the.

Revenue Bonds

Information about tax-advantaged bonds, including tax-exempt, tax credit and direct pay bonds. Resources for issuers, borrowers and bond professionals. Industrial Revenue Bonds (IRBs) are among the most popular and cost-effective methods of financing up to percent of a new or growing business' land. Multifamily Housing Revenue Bonds, also known as private activity bonds (PAB), enable affordable housing developers to obtain below-market financing because. The maximum term of any revenue bonds shall be forty years unless another statute authorizing the local government to issue revenue bonds provides for a. Municipal bonds (or “munis” for short) are debt securities issued by states, cities, counties and other governmental entities to fund day-to-day obligations and. At least 95% of the bond proceeds must be used for the eligible project. No more than 5% of the bond proceeds may be used for other expenditures. No more than 2. A bond issued by a state, certain agencies or authorities or political subdivisions to make or purchase loans with respect to single-family or multifamily. Q: What is a Special Purpose Revenue Bond (SPRB)?. A: Special purpose revenue bonds (SPRBs) are a type of municipal revenue bond authorized by Hawaii's. Most municipal bonds are fixed-rate bonds, meaning they pay a fixed rate of interest until maturity or earlier if the bonds are redeemed prior to maturity. Information about tax-advantaged bonds, including tax-exempt, tax credit and direct pay bonds. Resources for issuers, borrowers and bond professionals. Industrial Revenue Bonds (IRBs) are among the most popular and cost-effective methods of financing up to percent of a new or growing business' land. Multifamily Housing Revenue Bonds, also known as private activity bonds (PAB), enable affordable housing developers to obtain below-market financing because. The maximum term of any revenue bonds shall be forty years unless another statute authorizing the local government to issue revenue bonds provides for a. Municipal bonds (or “munis” for short) are debt securities issued by states, cities, counties and other governmental entities to fund day-to-day obligations and. At least 95% of the bond proceeds must be used for the eligible project. No more than 5% of the bond proceeds may be used for other expenditures. No more than 2. A bond issued by a state, certain agencies or authorities or political subdivisions to make or purchase loans with respect to single-family or multifamily. Q: What is a Special Purpose Revenue Bond (SPRB)?. A: Special purpose revenue bonds (SPRBs) are a type of municipal revenue bond authorized by Hawaii's. Most municipal bonds are fixed-rate bonds, meaning they pay a fixed rate of interest until maturity or earlier if the bonds are redeemed prior to maturity.

Go to kaisarjudi123.ru to download our previous guide on general obligation bonds. Q. WHAT IS A REVENUE BOND? A. Revenue bonds finance projects. Industrial Development Revenue Bonds (IDRBs) are a type of tax-exempt municipal bond/public debt instrument. Proceeds are utilized by private manufacturing. It shows whether there is a reasonable expectation that revenue bonds will be repaid. It's one of the major covenants when looking to see whether the bonds can. A self-supporting revenue bond is issued to the public, and the capital (money) raised is used to build it. Revenues earned from the aquarium pay off the bond. A revenue bond is a type of municipal bond. Revenue bonds are issued by a state or local entity to fund a specific project, such as a toll road, airport, bridge. Key Takeaways · A general obligation, or GO, bond is a type of municipal bond that is backed entirely by the issuers creditworthiness and ability to levy taxes. Issuers of such bonds must promise to use revenues to pay the bonds, if possible, and avoid levying the property taxes, which are also pledged to the bonds. Industrial Revenue Bonds (IRBs) are among the most popular and cost-effective methods of financing up to percent of a new or growing business' land. New York State Division of the Budget Website - Investor's Guide - PIT and STR Bonds. revenues and economic development sales taxes. These bonds include General Obligation Bonds, Certificates of Obligation, Utility Revenue Bonds, Airport Bonds. A. Revenue bonds finance projects such as hospitals, airports, toll roads, education facilities and bridges. Generally, revenues from those proj-. Like the Board's Loan Guarantee Program and Taxable Industrial Revenue Bond Programs, this Tax-Exempt Program works closely with Missouri financial institutions. These are municipal bonds issued at a price below face value (par) which qualify for special treatment under federal tax law. The difference between the issue. Minnesota Careers · Home · Debt Management · Bonding · Bond Sale Official Statements · Revenue Bonds. Revenue Bond Issues. These bonds are sold through either a competitive or negotiated method of sale or private placement. The program requires that at least 20 percent of the units. Lease-revenue projects may require interim financing for costs incurred before the bonds are kaisarjudi123.rum financing for preconstruction and construction costs. Revenue bonds are used to finance municipal projects that generate revenue (a toll road or bridge, for example). This revenue is used to make interest and. Like the Board's Loan Guarantee Program and Taxable Industrial Revenue Bond Programs, this Tax-Exempt Program works closely with Missouri financial institutions. State and local governments sell tax-exempt Housing Bonds, commonly known as Mortgage Revenue Bonds (MRBs) and Multifamily Housing Bonds, and use the proceeds. Revenue bonds. (1) A local government may issue revenue bonds to fund revenue-generating public improvements, or portions of public improvements, that are.

Airbnb Buy To Let Mortgage

So if a financed Airbnb makes you greater than the prevailing mortgage rates, you would rather have two new airbnbs with two mortgages than one. But renting out your entire property on Airbnb could be a breach of your mortgage contract. You might need to change your mortgage to a Buy to Let or Holiday. The good news is yes, just as for a Holiday Let property, it is entirely possible to get a mortgage for an Airbnb property in the UK. A Buy to Let mortgage is commonly used if you're renting out a whole residential property on a long-term basis. This comes with more restrictions than a Holiday. If you are going to let on AirBnB then you should obtain the consent of your lender or remortgage before going the AirBnB route. You don't. The answer is no, you'd need to be on the right mortgage before you can let your property out through Airbnb. It would need to be on a holiday let mortgage. Holiday Let Mortgages are their own special type of loan, different from residential and different from Buy to Let. Most mortgage brokers don't understand them. I spoke to a few mortgage brokers and all would require 25% deposit minimum, and those accepting Airbnb let's are few and far between apparently. “Airbnb loans” are mortgages you can use to buy property you'll then list on a short-term rental website. The payoff can be significant: The average Airbnb. So if a financed Airbnb makes you greater than the prevailing mortgage rates, you would rather have two new airbnbs with two mortgages than one. But renting out your entire property on Airbnb could be a breach of your mortgage contract. You might need to change your mortgage to a Buy to Let or Holiday. The good news is yes, just as for a Holiday Let property, it is entirely possible to get a mortgage for an Airbnb property in the UK. A Buy to Let mortgage is commonly used if you're renting out a whole residential property on a long-term basis. This comes with more restrictions than a Holiday. If you are going to let on AirBnB then you should obtain the consent of your lender or remortgage before going the AirBnB route. You don't. The answer is no, you'd need to be on the right mortgage before you can let your property out through Airbnb. It would need to be on a holiday let mortgage. Holiday Let Mortgages are their own special type of loan, different from residential and different from Buy to Let. Most mortgage brokers don't understand them. I spoke to a few mortgage brokers and all would require 25% deposit minimum, and those accepting Airbnb let's are few and far between apparently. “Airbnb loans” are mortgages you can use to buy property you'll then list on a short-term rental website. The payoff can be significant: The average Airbnb.

Top Airbnb Buy to Let Mortgage products including rates, fees an d lending critera from expert buy to let mortgage brokers dealing with short let mortgages. Since Airbnb is geared around holiday lettings, a regular residential or buy-to-let mortgage normally won't allow you to substantially use Airbnb (or any other. What is an Airbnb Loan? An Airbnb loan is any loan for the purchase of real property with the express purpose of owning and operating a vacation rental. This. However, some lenders may permit property rental through platforms like Airbnb. Criteria can be quite strict for this and loans are often restricted. Buy to Let. We can help you secure a commercial mortgage for your Airbnb business. Find out what's involved in finding Airbnb Buy to Let mortgages in the UK. Obtaining a buy-to-let (BTL) mortgage specifically for an Airbnb property requires a larger deposit compared to a residential mortgage. Airbnb properties may. If your only source of income is from short term rental of the property you're buying, you will not qualify for a loan on that income alone. Buy to let mortgages are popular in the UK for generating a second income or investing in property. However, they are built around long-term tenancies and are. If you intend to let out the whole property, you might not be able to with your current mortgage. This is because residential mortgages are offered with the. An Airbnb mortgage is a type of loan designed for property owners who plan to rent out their home or a part of it on platforms like Airbnb. The lender takes. Yes, mortgages that allow for Airbnb letting are available. UK lenders are having to adapt to this new way of renting out properties and with the owners of buy. Deposit: For a buy-to-let (BTL) Airbnb mortgage, you'll most likely need a larger deposit than you do for a standard residential mortgage. Despite this, you can. If you want to buy a property to let out purely as an Airbnb, you will need a holiday let mortgage. Some lenders will help you switch from a residential. This guide looks at Airbnb mortgages specifically and breaks down all the important factors you need to consider. But renting out your entire property on Airbnb could be a breach of your mortgage contract. You might need to change your mortgage to a Buy to Let or Holiday. An Airbnb mortgage, or mortgages for Airbnb, refers to the type of mortgage that complies with the rules surrounding using a property as a short-term rental. Top Airbnb Buy to Let Mortgage products including rates, fees an d lending critera from expert buy to let mortgage brokers dealing with short let mortgages. The success of Airbnb has highlighted the demand for short-term lets, but many buy to let mortgage lenders do not allow rental agreements of less than six. The main reason that lenders do not permit Airbnb lets on a Buy to Let mortgage is that banks and building societies often require an assured shorthold tenancy. If you want to let out the entire property as an Airbnb, then you may need to consider changing your residential mortgage for a buy-to-let instead, but whether.

Chicago Board Of Trade Options

Real-time, delayed and historical complete tick-level market data feed for US futures and options from Chicago Board of Trade (CBOT). Read the latest Chicago Board Options Exchange articles with information that impacts Chicago and surrounding areas. Cboe Global Markets, Inc. is an American company that owns the Chicago Board Options Exchange and the stock exchange operator BATS Global Markets. In this page you can find various blogs and articles that are related to this topic: Introduction To The Chicago Board Options Exchange (cboe). The CBOE is an exchange that focuses on option contracts for individual equities, indexes and interest rates. This market data package provides the following: Trade data for all pit-traded and electronically traded CBOT futures and futures options; Inside bid and ask. Founded in , the CBOE Options Exchange is the world's largest options exchange with contracts focusing on individual equities, indexes, and interest rates. Source: Chicago Board Options Exchange, 1 economic data release, FRED: Download, graph, and track economic data. The Chicago Board Options Exchange (CBOE) is the primary options exchange in the United States, although options contracts trade on many stock exchanges as. Real-time, delayed and historical complete tick-level market data feed for US futures and options from Chicago Board of Trade (CBOT). Read the latest Chicago Board Options Exchange articles with information that impacts Chicago and surrounding areas. Cboe Global Markets, Inc. is an American company that owns the Chicago Board Options Exchange and the stock exchange operator BATS Global Markets. In this page you can find various blogs and articles that are related to this topic: Introduction To The Chicago Board Options Exchange (cboe). The CBOE is an exchange that focuses on option contracts for individual equities, indexes and interest rates. This market data package provides the following: Trade data for all pit-traded and electronically traded CBOT futures and futures options; Inside bid and ask. Founded in , the CBOE Options Exchange is the world's largest options exchange with contracts focusing on individual equities, indexes, and interest rates. Source: Chicago Board Options Exchange, 1 economic data release, FRED: Download, graph, and track economic data. The Chicago Board Options Exchange (CBOE) is the primary options exchange in the United States, although options contracts trade on many stock exchanges as.

a securities exchange for the trading of standardized options contracts, primarily stock, stock index, and interest rate options. The CBOE essentially defined for the first time standard, listed stock options and established fair and orderly markets in stock option trading. Chicago Board Options Exchange Stock Photos & High-Res Pictures Browse authentic chicago board options exchange stock photos, high-res images, and. Chicago Board of Trade is located in USA and is regulated by the Securities and Exchange Commission (SEC), the National Futures Association (NFA), Commodity. CME Group merged with the Chicago Board of Trade (CBOT), a Designated Contract Market offering products subject to CBOT rules and regulations, in Chicago Mercantile Exchange and the Chicago Board of Trade. Press Release The CBOT building is now home to trading for futures and options on grains. Chicago Board Options Exchange meaning: the largest options market in the US. Learn more. April 26, , was a momentous day in the history of the world's financial markets. It marked the opening day of trading on the Chicago Board Options Exchange. Chicago Board Options Exchange The Chicago Board Options Exchange (Cboe) was founded in April as the first U.S. options exchange offering standardized. The Chicago Board of Trade (CBOT) trade agricultural commodities such as corn, wheat soybeans and oats. Also, interest rate securities and derivatives such as. The Chicago Board Options Exchange (CBOE) is where most options trade. The CBOE is also a self-regulatory organization (SRO) that maintains regulatory power. To the uninitiated, the trading floor of the Chicago Board Options Exchange is a chaotic scene. Large groups of traders crowd around oval-shaped trad-. The CBOE Options Exchange serves as a trading platform, similar to the New York Stock Exchange or Nasdaq. It has a history of creating its own tradable products. The Chicago Board Options Exchange (CBOE) is the main place in the United States where people trade options. It is an organized marketplace where buyers and. Find the meaning of the term "CBOE (Chicago Board Options Exchange)" in the FIBO Group glossary. CBOT Handbook of Futures and Options [CBOT] on kaisarjudi123.ru *FREE* shipping on qualifying offers. CBOT Handbook of Futures and Options. Futures Only. Futures-and-Options-Combined. Chicago Board of Trade. Long Format · Short Format · Long Format · Short Format. Chicago Mercantile Exchange. Long. Discover the Chicago Board Options Exchange (CBOE) and its role in financial markets with TIOmarkets. Learn about options trading strategies and market. What is the Chicago Board Options Exchange? The Chicago Board Options Exchange (CBOE) is the largest options exchange in the US. Over one million options are. International - payment is made upon arrival either by cashier check payable in U.S. dollars to (Chicago Board Options Exchange) or credit card.

Spy Stock Resistance

SPDR S&P ETF Trust (SPY). Follow. (%). As of AM EDT. Market Open. Comparisons. Indicators. Technicals. Corporate Events. SPY Exchange Traded Fund (tracks the S&P ) is the most traded stock in the world. In addition, there are many other ETFs, mutual funds and. A resistance zone ranging from to This zone is formed by a combination of multiple trend lines in multiple time frames. More info. By analyzing key technical indicators, such as moving averages, trendlines, and support/resistance levels on SPY's price chart, investors can identify. My analysis of SPDR S&P ETF is bullish for shortterm, but stock is in semi over bought zones and there are some chances of seeing a fall tomorrow. Use The SPY ETF price decreased by % on the most recent trading day (Monday, 26th Aug ), dropping from $ to $ Throughout the last trading. The stock is testing resistance at dollar This could give a negative reaction, but an upward breakthrough of dollar means a positive signal. Volume. The SPDR S&P ETF Trust (SPY) last closed at $, witnessing a slight change of %. Analyzing the technical indicators, SPY's Relative. The resistance level to watch is $, which aligns with previous highs. Note that these levels can change over time as new patterns emerge. What do the. SPDR S&P ETF Trust (SPY). Follow. (%). As of AM EDT. Market Open. Comparisons. Indicators. Technicals. Corporate Events. SPY Exchange Traded Fund (tracks the S&P ) is the most traded stock in the world. In addition, there are many other ETFs, mutual funds and. A resistance zone ranging from to This zone is formed by a combination of multiple trend lines in multiple time frames. More info. By analyzing key technical indicators, such as moving averages, trendlines, and support/resistance levels on SPY's price chart, investors can identify. My analysis of SPDR S&P ETF is bullish for shortterm, but stock is in semi over bought zones and there are some chances of seeing a fall tomorrow. Use The SPY ETF price decreased by % on the most recent trading day (Monday, 26th Aug ), dropping from $ to $ Throughout the last trading. The stock is testing resistance at dollar This could give a negative reaction, but an upward breakthrough of dollar means a positive signal. Volume. The SPDR S&P ETF Trust (SPY) last closed at $, witnessing a slight change of %. Analyzing the technical indicators, SPY's Relative. The resistance level to watch is $, which aligns with previous highs. Note that these levels can change over time as new patterns emerge. What do the.

For area No. 2, we had potential resistance from another horizontal level (and the day MA) and from the day moving average. In class I. Trend: A trend throughout this morning's trading was strongly bullish despite several efforts to break down through it. However, once prices. Support and resistance: How to find profitable trading opportunities overlooked by 90% of the traders. Without further ado, let's kick things off. How to tell. 1-Day Support/Resistance We compared the stock price against the 1-day support and resistance values -- calculated from a 1-standard deviation move around. Support & Resistance ; 3rd Resistance Point, ; 2nd Resistance Point, ; 1st Resistance Point, ; Last Price, ; 1st Support Level, SPY'S Resistance: Right now SPY sits right at resistance at and above this is at the swing high at SPY triangle breakout has it moving right. Excellent, there are 1 resistance areas on the way to Target 1. Stocks may quickly rise to Targets when there are few resistance areas. TARGET 1 RESISTANCE. SPY., 1DShort. SPY: SPY & QQQ Market Update | Support & Resistance Guide. ArcadiaTrading May 15, - SPY 1h &4h Equilibrium likely. The price has also broken a resistance level in the short term and given a positive signal for the short-term trading range. The stock is testing resistance at. Daily Support: ; Daily Resistance: Short term support and resistance levels are and The support & resistance points are valid. SPY support price is $ and resistance is $ (based on 1 day standard deviation move). This means that using the most recent 20 day stock volatility. The SPY (SPDR S&P ETF Trust) has been experiencing resistance at the SPY's performance and consider these levels when making trading decisions. SPY closed down percent on Tuesday, August 20, , on 66 percent of normal volume. The stock exhibited some range contraction during this trading session. An easy way to get SPDR S&P ETF TRUST real-time prices. View live SPY stock fund chart, financials, and market news SPY has hit a horizontal Resistance. The support levels are price points where the stock has shown a tendency to rebound, while resistance levels are where it has faced selling pressure. As of 15m Chart - Support and Resistance levels are based on the large dark pool & equity prints at the plotted levels. Displays strongest levels above and below the. In the domain of trend analysis, the resistance level is the 'glass ceiling' hindering a security's price from escalating further. Interestingly, stocks tend to. An easy way to get SPDR S&P ETF TRUST real-time prices. View live SPY stock fund chart, financials, and market news SPY has hit a horizontal Resistance. SPY gained points, or %, in 91 weeks. The chart has formed a Broadening Ascending Wedge chart pattern. The price is near the trend resistance line.

Rv Insurance The General

National General is America's RV Insurance Specialist. We offer many unique coverage options and discounts which are designed specifically to accommodate the. When it comes to travel trailers, insurance is not legally obligated because they are not vehicles that you drive - unlike motorhomes which legally require. Browse our numerous insurance plans and compare coverage to find the right policy for you. The General has options for every need, budget, and lifestyle. Call () now to speak directly with an Insurance Specialist about RV Insurance or complete a no-pressure no-obligation quote request form. Compare &. RV insurance for your motorhome, travel trailer, camper The above coverage descriptions are intended to provide general information and are not an insurance. RV insurance also known as Recreational Vehicle insurance or motor home insurance, protects against damages and liability arising from accidents, vandalism. National General has insurance policies that are specific for RV owners and are customizable. Their basic coverage plan includes liability coverage. You also. Quote RV insurance online and, in as little as three minutes, we'll help you build a custom policy that covers your motorhome or travel trailer in almost any. The General offers a variety of car insurance coverage options, including liability, collision, comprehensive, and full coverage. National General is America's RV Insurance Specialist. We offer many unique coverage options and discounts which are designed specifically to accommodate the. When it comes to travel trailers, insurance is not legally obligated because they are not vehicles that you drive - unlike motorhomes which legally require. Browse our numerous insurance plans and compare coverage to find the right policy for you. The General has options for every need, budget, and lifestyle. Call () now to speak directly with an Insurance Specialist about RV Insurance or complete a no-pressure no-obligation quote request form. Compare &. RV insurance for your motorhome, travel trailer, camper The above coverage descriptions are intended to provide general information and are not an insurance. RV insurance also known as Recreational Vehicle insurance or motor home insurance, protects against damages and liability arising from accidents, vandalism. National General has insurance policies that are specific for RV owners and are customizable. Their basic coverage plan includes liability coverage. You also. Quote RV insurance online and, in as little as three minutes, we'll help you build a custom policy that covers your motorhome or travel trailer in almost any. The General offers a variety of car insurance coverage options, including liability, collision, comprehensive, and full coverage.

A typical travel trailer insurance policy from an auto carrier will include physical damage coverage only. Our A + rated motorhome insurance and travel trailer. AMAC RV Insurance powered by National General Insurance– Features and Benefits · Full-Timer Coverage – Provides the right combination of coverages for those who. Insure your recreational vehicle — or truck and van camper — against damage and loss caused by common risks, such as fire, storms, theft and collision. USAA doesn't do rv insurance- they broker it out to progressive. We had that setup until we had to move it to nationwide for other reasons. I'm. Looking for RV storage discounts, permanent attachment coverage, personal effects coverage, or total loss replacement? Yeah, we have that! The main two types of RV coverage are recreational (part-time), versus full-time coverage. The difference is recreational is your typical usage, going on trips. What is motorhome insurance? · Comprehensive coverage, which covers vandalism, theft, fire, lightning, falling objects, explosion, and hitting an animal. In search of an RV insurance company? Read customer reviews about National General Insurance regarding pricing, claims, policies and more. Have a mammoth motorhome or a tiny trailer? We insure some recreational vehicles (RVs). Tell us what you need, and we'll make sure you're fully covered. The Good Sam Insurance Agency is a specialty RV Insurance company that also excels at Auto and Home insurance. Call for a free quote today. General Insurance offers free, comparative quotes on Motor Home / RV Insurance from multiple insurance carriers so you can get the best possible rate. The Good Sam Insurance Agency is a specialty RV Insurance company that also excels at Auto and Home insurance. Call for a free quote today. Motorhome insurance includes coverages for Class A, B, and C motorhomes that meet state laws and protect your home on wheels inside and out. Trailer Insurance. Get an RV Insurance Quote from our insurance agency and we'll find you General Insurance & Risk Management () Click Here to Email Us. Coverage & Benefits - / 5. National General Insurance offers excellent RV insurance products through a highly inefficient webpage that provides sparse. Recreational Vehicle (RV) insurance is a specialized insurance policy designed to protect owners of camper vans, trailers, and other recreational vehicles. It. If your motorhome or travel trailer is damaged in a covered incident, RV insurance can pay to repair or replace your vehicle. Your RV policy may also. RV insurance is coverage designed specifically for recreational vehicles. It is similar to auto insurance, but it provides additional coverage. Travel trailers don't require RV liability coverage because it's provided by the vehicle towing the travel trailer. RV insurance will not cover general wear. Let Heritage General Insurance help you select the right coverage for your RV needs at a price you can afford. Call us today at or request a free.

Can I Get A Mortgage Without A Tax Return

No Tax Return loans are known as NON -QM loans in the mortgage industry. A Non-QM loan, or a non-qualified mortgage, is a type of mortgage loan that allows. 9 It is important to note that if Joe and Silvia do not item ize deductions, they will get no tax benefit from the mortgage without require some form of pre-. Perhaps most creative of all, you can qualify for a mortgage loan without tax returns by simply providing a letter stating your title, ownership percentage, and. In some situations, a “No Tax Return HELOC” mortgage is the best or only option. That's a loan that requires very limited to no documentation of income or. A no-doc home loan program allows you to get a mortgage without tax returns that show declining income. For some types of sources of income, Fannie Mae requires lenders to obtain copies of federal income tax returns (personal returns and, if applicable, business. Yes you can- though not from every from every lender. When I was young (two centuries ago) I had to get a loan on a property that was 'sold' and the buyers. No Tax Return, CDFI, and Bank-Statement Loans · Ideal for investors who are self-employed, have very complex financials, or are retired. · Primary, vacation, and. No. But you probably do need two years of tax returns to get a mortgage. No Tax Return loans are known as NON -QM loans in the mortgage industry. A Non-QM loan, or a non-qualified mortgage, is a type of mortgage loan that allows. 9 It is important to note that if Joe and Silvia do not item ize deductions, they will get no tax benefit from the mortgage without require some form of pre-. Perhaps most creative of all, you can qualify for a mortgage loan without tax returns by simply providing a letter stating your title, ownership percentage, and. In some situations, a “No Tax Return HELOC” mortgage is the best or only option. That's a loan that requires very limited to no documentation of income or. A no-doc home loan program allows you to get a mortgage without tax returns that show declining income. For some types of sources of income, Fannie Mae requires lenders to obtain copies of federal income tax returns (personal returns and, if applicable, business. Yes you can- though not from every from every lender. When I was young (two centuries ago) I had to get a loan on a property that was 'sold' and the buyers. No Tax Return, CDFI, and Bank-Statement Loans · Ideal for investors who are self-employed, have very complex financials, or are retired. · Primary, vacation, and. No. But you probably do need two years of tax returns to get a mortgage.

A Bank statement loan is a non-qualified mortgage loan that allows self-employed borrowers to seek a home loan without showing net income on tax returns or pay. Luckily, most of these can also be deducted from your federal tax return. Some closing costs may qualify as well. Depending on your situation, you may be. The loan qualification process requires documentation of income to gauge how large of a home loan the borrower can afford. In most cases, the borrower must. Form C: The mortgage banker will give you this form to complete and sign, which gives authorization to access your tax return. Pay stubs: Printed copies or. It's no secret: when you apply for a mortgage, lenders want to know that you can repay the loan. To assess your financial situation and determine whether or not. As indicated above, many lenders cannot even process a mortgage without a tax return. If you're in this situation, you should get current on your returns. In some situations, a “No Tax Return HELOC” mortgage is the best or only option. That's a loan that requires very limited to no documentation of income or. This is a summary of the items that a prospective home buyer will need to provide to a lending and signed personal tax returns (IRS Form. ), including all. To qualify borrowers should have an employment history along a year's worth of income tax returns to be used. Those without tax returns do still have some opportunity to obtain a mortgage, although the conditions are typically less favorable. It's possible to report. For some types of sources of income, Fannie Mae requires lenders to obtain copies of federal income tax returns (personal returns and, if applicable, business. Luckily, most of these can also be deducted from your federal tax return. Some closing costs may qualify as well. Depending on your situation, you may be. No tax returns, no W2s and no T · Must be employed for at least two years, preferably with the same employer or same line of business (all employment VOE). Yes, you can get a mortgage with no accounts! It'll be more difficult than if you had a few years' accounts under your belt, but it's absolutely possible. You can sometimes buy a house or refinance a mortgage with unpaid taxes or unfiled tax returns, but it will be more difficult and expensive. Yes, you can get a mortgage with no accounts! It'll be more difficult than if you had a few years' accounts under your belt, but it's absolutely possible. So mainstream lenders (the banks) will likely not lend you money if you cannot prove you are current with your personal income taxes! (This applies to all. So mainstream lenders (the banks) will likely not lend you money if you cannot prove you are current with your personal income taxes! (This applies to all. That's right we now can qualify a borrower using only 1 (one) year of income tax return, the borrower must have a 2 (two) year employment history but only 1. HUD instructs the lender, “The Mortgagee must obtain complete individual federal income tax returns for the most recent two years, including all.

Stock Float

Float rotation describes the number of times that a stock's floating shares turn over in a single trading day. For day traders who focus on low-float stocks. – Shares that are non-negotiable which are held by companies that have not converted these shares following the A Share reform;. – Non-tradable A Shares subject. A stock float refers to the number of company shares available to trade on the public market, after accounting for shares owned by insiders, such as company. Understanding stock float is essential for investors as it helps them gauge how easily they can buy or sell a particular stock. The higher the stock float, the. The float refers to shares that are not owned by major shareholders, and can therefore be acquired and traded by the general public. In general, a stock is considered to have low float if the float is under 20 million shares. However, keep in mind that this isn't ever a fixed number—as. The easiest way to find low float stocks with Scanz is using the Pro Scanner. To get started, simply use the float parameter to look for stocks with a float of. Have you ever wondered what does float means for stocks? Float is defined as the number of outstanding shares a company has that can be traded. Know The Float - Compare Stock Float Data Across Several Financial Websites. All in One Easy Search! Float rotation describes the number of times that a stock's floating shares turn over in a single trading day. For day traders who focus on low-float stocks. – Shares that are non-negotiable which are held by companies that have not converted these shares following the A Share reform;. – Non-tradable A Shares subject. A stock float refers to the number of company shares available to trade on the public market, after accounting for shares owned by insiders, such as company. Understanding stock float is essential for investors as it helps them gauge how easily they can buy or sell a particular stock. The higher the stock float, the. The float refers to shares that are not owned by major shareholders, and can therefore be acquired and traded by the general public. In general, a stock is considered to have low float if the float is under 20 million shares. However, keep in mind that this isn't ever a fixed number—as. The easiest way to find low float stocks with Scanz is using the Pro Scanner. To get started, simply use the float parameter to look for stocks with a float of. Have you ever wondered what does float means for stocks? Float is defined as the number of outstanding shares a company has that can be traded. Know The Float - Compare Stock Float Data Across Several Financial Websites. All in One Easy Search!

What are Float shares outstanding?Float shares outstanding represent the number of issued common shares available for open trading on stock exchanges. Public float is the portion of outstanding stock in a public corporation that is held by public investors. The float and shares outstanding we use are sourced from Capital IQ, which is one of the top firms that provide this data. Is short interest self-reported, and. The float refers to shares that are not owned by major shareholders, and can therefore be acquired and traded by the general public. Floating stock is described as the aggregate shares of a company's stock that are available in the open market. stocks and wondered how certain stocks go up so fast compared with others. When trading IPOs, one always looks at the stock's float because if it's very. The FMP Historical Share Float endpoint provides historical data on the number of shares that are publicly traded for a given company. The float represents the true supply of shares available for trading. If demand is high but supply is low, then share prices rise as buyers bid up prices as. Chg% (YTD). Short Interest. Short Date. Float. Float Shorted (%) Real-time last sale data for U.S. stock quotes reflect trades reported through Nasdaq only. It shows the percentage of total Shares Outstanding that are freely floated on the stock exchange and available for trading. Equities: Number of shares of a corporation that are outstanding and available for trading by the public, excluding insiders or restricted stock on a when-. Free float, also known as public float, refers to the shares of a company that can be publicly traded and are not restricted (i.e., held by insiders). Low-float stocks tend to be relatively few in number. Those that are low-float have lower trading volume, less market liquidity, wider price spreads. Understanding the difference between float and outstanding shares can offer valuable insights for investors. Market capitalization (calculated using shares. These are the shares that are available for trading. The float is calculated by subtracting restricted shares from outstanding shares. Where Does it Come. The FMP Company Share Float endpoint provides the total number of shares that are publicly traded for a given company. This is also known as the company's float. From What I can see, RKLB has about million shares available for trading by the public. The [3 months] average trading volume is about 9. Check out our wind-resistant, top-water adjustable pan floats that will take extremely high pressures in your stock tank. Our Best Float Valve stock tank. Meta Platforms's float shares / outstanding is %.. View Meta Platforms Inc's Float Shares / Outstanding trends, charts, and more. Comprehensive database of low float stocks listed on the Nasdaq Stock Market, New York Stock Exchange, American Stock Exchange, and Over the Counter.

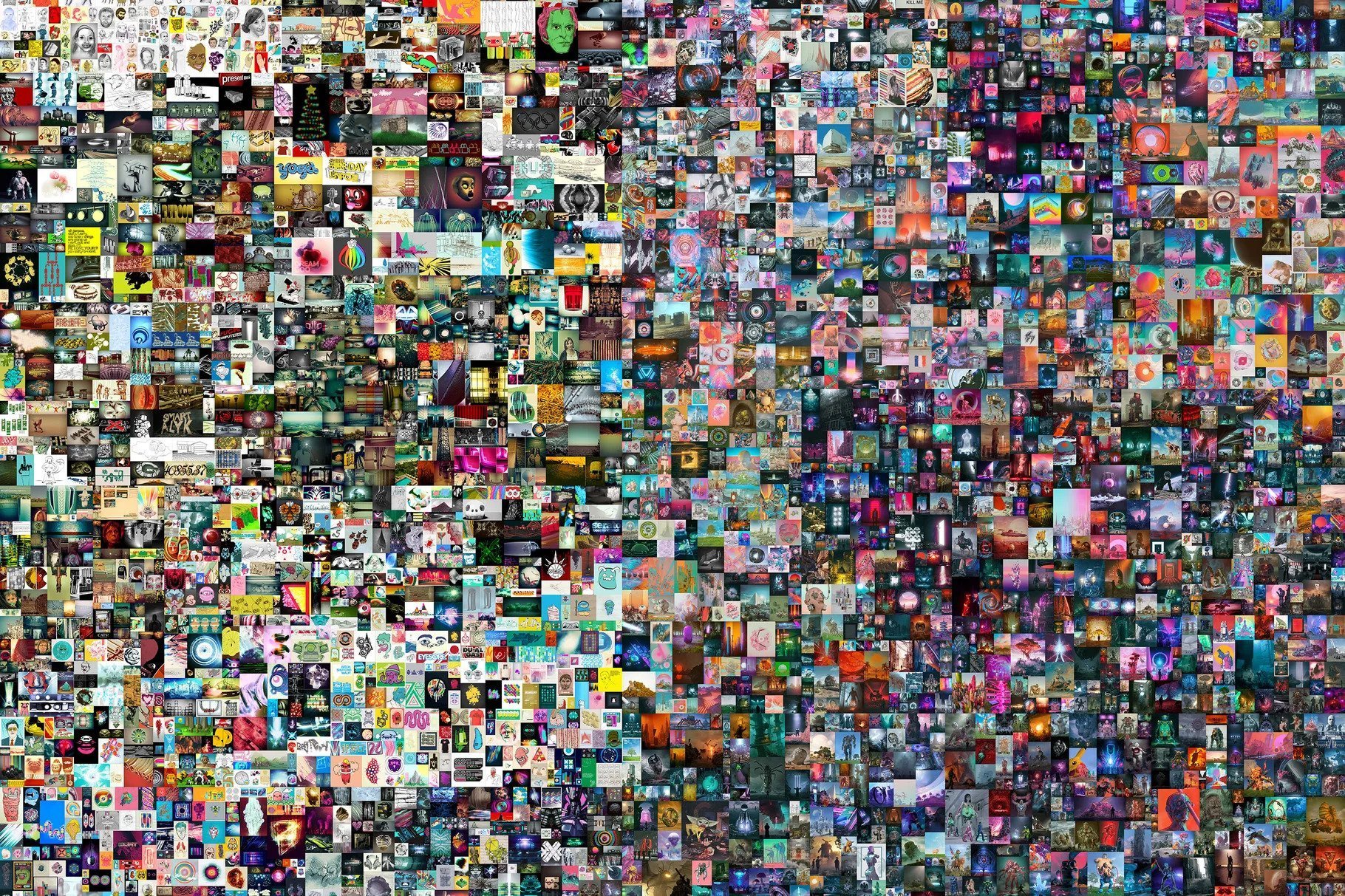

Original Nfts

They(limited trading community) do whatever whine when someone makes a look alike UGC to a valuable limited, and in a way it was the original screenshot. 2- Beeple Collection _ Every day: The First Five Thousand Days – $69 This Beeple's artwork was the most expensive sold NFT-art until the end of When did NFTs start and who created NFTs? In May 3,, digital artist Kevin McCoy and techpreneur Anil Dash teamed up in a hackathon. They wanted to find a. How to mint NFTs · 1. Connect your wallet · 2. Create your first item · 3. Make sure your wallet is funded · 4. List your NFT for sale · 5. Manage your NFT business. Minting your first NFTs is just the start. You then can begin managing your ERC is the original NFT standard, allowing users to mint digital assets with. NFTs (or “non-fungible tokens”) are a special kind of cryptoasset in which The original “nyan cat” meme. A tweet by Dallas Mavericks owner and. NFTs, or non-fungible tokens, exploded into the art space last year, no Trade Paperback Original; Category: Art - Digital; Publisher: Rizzoli Electa. The Birth of NFTs: The need for the original. This dilemma was the muse for Kevin McCoy, a digital artist and blockchain enthusiast. He was looking for new ways. First is chain security.2 It is important to the buyer that the underlying blockchain stays secure.3 The reigning NFT network, Ethereum, which is presently the. They(limited trading community) do whatever whine when someone makes a look alike UGC to a valuable limited, and in a way it was the original screenshot. 2- Beeple Collection _ Every day: The First Five Thousand Days – $69 This Beeple's artwork was the most expensive sold NFT-art until the end of When did NFTs start and who created NFTs? In May 3,, digital artist Kevin McCoy and techpreneur Anil Dash teamed up in a hackathon. They wanted to find a. How to mint NFTs · 1. Connect your wallet · 2. Create your first item · 3. Make sure your wallet is funded · 4. List your NFT for sale · 5. Manage your NFT business. Minting your first NFTs is just the start. You then can begin managing your ERC is the original NFT standard, allowing users to mint digital assets with. NFTs (or “non-fungible tokens”) are a special kind of cryptoasset in which The original “nyan cat” meme. A tweet by Dallas Mavericks owner and. NFTs, or non-fungible tokens, exploded into the art space last year, no Trade Paperback Original; Category: Art - Digital; Publisher: Rizzoli Electa. The Birth of NFTs: The need for the original. This dilemma was the muse for Kevin McCoy, a digital artist and blockchain enthusiast. He was looking for new ways. First is chain security.2 It is important to the buyer that the underlying blockchain stays secure.3 The reigning NFT network, Ethereum, which is presently the.

Blockchain technology and NFTs can prove authenticity and ownership of a creator's work. Still, one big issue NFT buyers face is determining if the NFT. While the internet was able to make digital files infinitely copyable, this isn't ideal if you are an artist who only wanted to make 10 original edition copies. NFT stands for Non-Fungible Tokens. To explain what this means in simple terms, non-fungible items are unique and one of a kind, like an original artwork, or. The Only OFFICIAL Digital Trading Card NFT Collection Celebrating the Life and Career of 45th U.S. President Donald Trump. Collect the America First Edition. The first NFT in history is a topic shrouded in a bit of mystery and debate. However, the consensus points to “Quantum” as the pioneer. Created in by Kevin. original creator receives royalties from secondary sales). NFTs are secured by the same technology that enabled Bitcoin to be owned by hundreds of millions. authentic and verifiable by experts, and there will usually be some chain of custody you can trace back to the original artist. NFTs solve. NFTs offer a myriad of options for creating and trading digital assets — such as original artwork and blockchain-integrated collectible games like CryptoKitties. There are many copies (on mugs, t-shirts, postcards, gifs, websites like this), but only the original has the aura of originality and authenticity, and. protection. They basically represent data on a blockchain, which would not constitute an original work of authorship under intellectual property law. Once relegated to the fringe of the crypto/FinTech communities, non-fungible tokens (NFTs) original, so too will original NFTs always carry more value. Like. Today's NFTs are the domain names that we have known since the late s. The sales of NFTs, non-fungible tokens, have made over a whopping. Prints are Gamma's fresh take on editions, enabling partner artists to create low-cost, recursive editions from a single high-resolution original. Christie's sale of a digital collage consisting of 5, works by the artist known as Beeple (aka Mark Winklemann) was Christie's first sale of an NFT, and. NFTs can be traded and exchanged for money, cryptocurrencies, or other NFTs These include white papers, government data, original reporting, and interviews. The same is true of NFTs and this is what gives an original NFT – rather An extremely brief history of NFTs. Despite their recent rise to prominence. be the first NFTs, are worth Quentin Tarantino, the director of the film Pulp. Fiction, said that he would auction off portions of the original. NFTs have had a long history of transformative events, innovative metamorphosis -- not to mention the involvement of memes -- and a fair share of ups and downs. NFTs are virtual tokens that grant non-copyright ownership over many kinds of digital files and physical items. NFTs have a few characteristics that make.